The World Business Council for Sustainable Development (WBCSD) is a global, CEO-led organization of over 200 leading businesses working together to accelerate the transition to a sustainable world. They collaborate on sustainable business solutions, advocate for policies that enable sustainable development, and drive corporate action on environmental and social challenges.

Historically, and in the context of engaging with the “E” of “ESG”, the lion’s share of businesses' attention has been dedicated to net zero efforts, (over)utilization of natural resources, and impacts of operations on the environment. The notion of adapting to future climate risks, however, is too often absent or deemphasized, despite an abundance of evidence that points to a future of increased climate risks and related disruptions. As our report introduction points out, only one in five businesses currently have a plan in place to tackle climate adaptation.

Climate adaptation is frequently marginalized. It’s perceived as secondary to combating climate change, despite numerous studies that stress its critical importance for both businesses and governments. There is a pressing need to prioritize climate adaptation with the same urgency and attention devoted to reducing the global carbon footprint.

As we point out in our report, the most successful businesses are precisely the ones that adapt the fastest: constantly innovating in the face of shifting consumer demands, evolving regulatory landscapes, supply chain disruptions, and the emergence of new technologies. Yet, adaptation to climate change, arguably one of the most pressing issues of our time, is too often treated as a secondary concern.

Jupiter, the WBCSD, and our partners at Bain & Company recently co-developed and published The Business Leaders Guide to Climate Adaptation & Resilience. The guide seeks to catalyze action and investments from the business community by providing tools and case studies to accelerate climate adaptation efforts across companies, safeguarding against risks, and unlocking new opportunities.

The following highlights some of Jupiter’s key contributions to this report.

Risk Identification Provider and Input Data Gathering

Before kicking off any climate risk assessment work, one of the key challenges is to identify a risk identification provider. In this report, we set off to identify some of the main aspects to look for in this process:

- Access to multiple global climate models including latest generation CMIP6 models

- Globally consistent data outputs

- Quantifiable peril metrics (i.e., height of the flood water, speed of the wind) to avoid “black box,” qualitative type of risk scoring

- Models which capture the non-stationary nature of climate change and are not entirely driven by historical observations

The section discusses the different strengths and weaknesses of provider options. See pp. 22–23 of the report for more information. More information on this topic can be found in a previous Jupiter blog post here.

Other topics discussed in this section touch on the challenges of scoping and data collection efforts when starting a climate risk assessment journey. We recognize that this step depends widely on the distinct specifics of individual companies and industries. Typically, we do encourage clients to carefully consider emission scenario options, to take into account large assets with material cascading risks, and to think about mapping asset classes to climate hazards that could result in the exceeding of design thresholds. For more information, consult p. 20 of the report. For further details on the “climate adaptation maturity assessment”, consult p. 83.

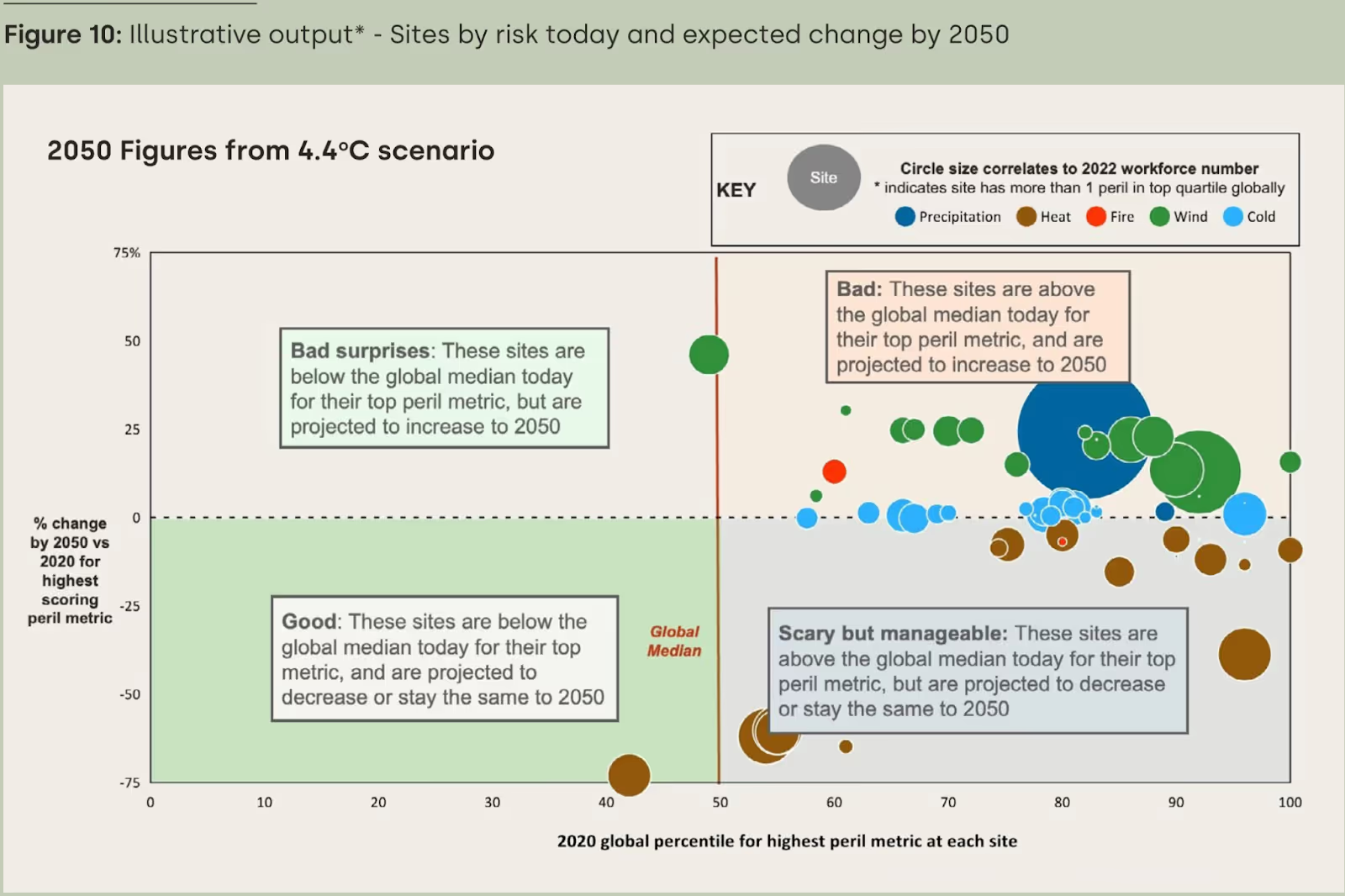

Risk Quadrant—Case Studies with Major Commodity Company

Jupiter and our partners at Bain jointly introduce a case study carried out for a major commodities company in p. 26 of the report.

In this section, we discuss an approach to assessing portfolio-level climate risk by introducing the concept of a present-day vs. future change risk quadrant.

This approach leverages Jupiter’s own ClimateScore™ Global hazard scores, a useful way of synthesizing the various peril metrics that are modeled “under the hood” in our own data offering.

In this quadrant, we visualize major capital-intensive assets owned and operated by this client. The visual is tailored for an executive audience and allows us to immediately convey several dimensions at play here:

- On the X axis, we look at the projected exposure for the highest-scoring peril metric in the present day. All scores are computed as a global percentile. In other words, an asset with a present-day score of 20 for a given peril ranks in the 20th percentile globally in present day exposure for that peril.

- On the Y axis, we look at the projected future change between 2020 and 2050 for the highest scoring peril metric.

- Finally, the size of the bubble indicates the 2022 workforce number onsite which is used as an approximate proxy for the value of the asset to the business.

This type of quadrant immediately allows a viewer to determine which clusters are exposed in the present day, which assets experience higher levels of relative change in exposure in coming decades, and assets exposed to a combined present-day and future change exposures.

In this case, we identify an asset, depicted as a large blue bubble, that faces a trifecta of potential challenges: high levels of present-day exposures to acute precipitation, high levels of future change, and the presence of a sizable workforce onsite.

Financial Impact Quantification

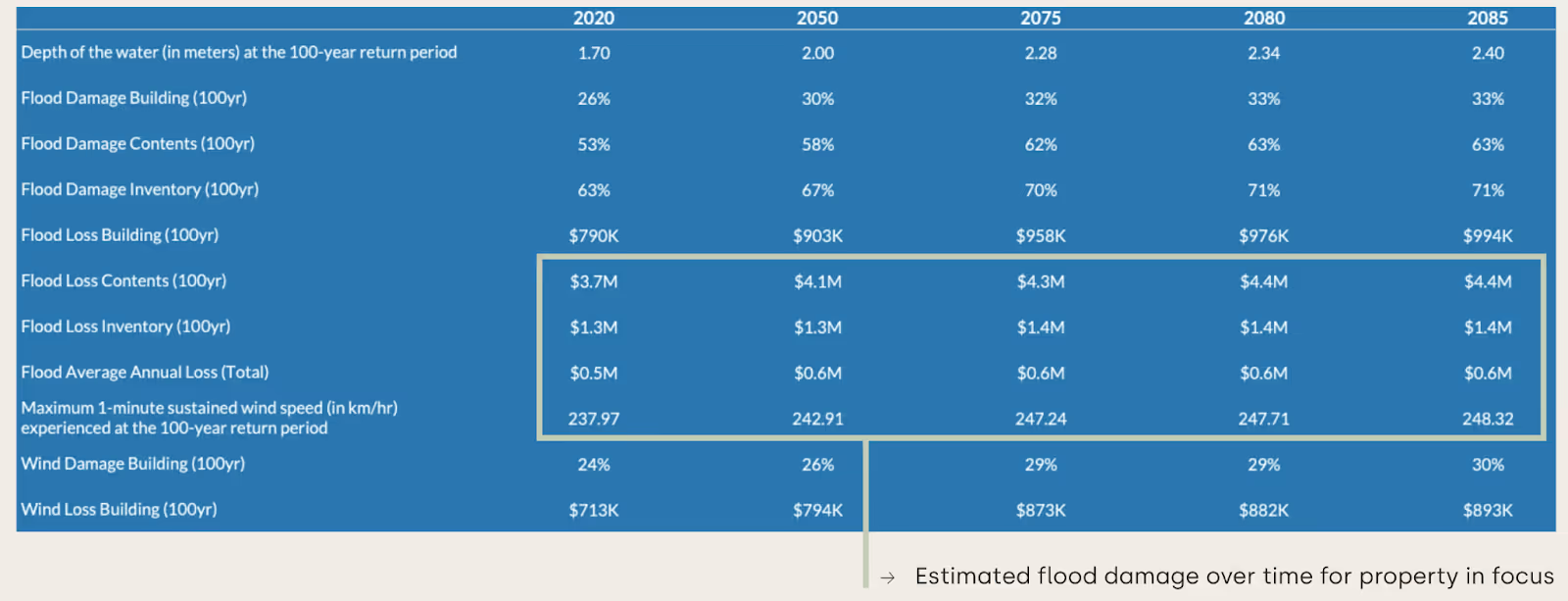

In Section D of the report, Jupiter contributed to a reflection on the different approaches to risk quantification (see p. 21). To provide an example of how to quantify the financial impact from acute flooding and windstorms, we look at a supplier site for a leading apparel manufacturer.

Our integrated damage and loss modules leverage loss estimation methodologies to project estimated flood and wind loss at different return periods. In the example above, we provide estimated flood damage to the asset after considering its occupancy type, first floor elevation, and other building features that the site benefits from. Our damage functions allow us to compute expected damage and loss to building, contents and equipment and stored inventory (p. 43).

An even deeper dive into this individual site could also yield estimates of expected downtimes in the form of business interruption.

Conclusion

The Business Leaders Guide to Climate Adaptation & Resilience is the fruit of months of collaborative efforts between Jupiter, WBCSD, and our partners at Bain & Company.

Integral to this work were key testimonies brought forth by WBCSD members organizations like Phillips, Nestle, and Bayer, as well as other tangible examples of best practices in deploying climate adaptation from organizations like AstraZeneca, Anglo American, and BASF.

Jupiter provided a technical framework to groundbreaking thinking about climate adaptation, and we look forward to bringing our leading-edge climate data to support climate risk assessments for your organization.

For more information, contact us at info@jupiterintel.com or request a demo.

.webp)