ClimateScore Global

Purpose-Built for Banks and Financial Institutions

Financial institutions are on the front lines of managing economic risk—and climate change is reshaping that landscape. ClimateScore Global empowers financial institutions with the tools they need to understand and respond to physical climate risks across global portfolios. It helps identify exposure, pinpoint vulnerable assets and regions, assess how risks evolve over time, and uncover opportunities to strengthen resilience, meet disclosure mandates, and inform strategic decision-making.

Jupiter works directly with banks’ Model Risk Management (MRM) to seamlessly integrate climate risk analytics into enterprise risk frameworks—ensuring models are not only accurate but also MRM-validated. Every dataset, forecast, and model from Jupiter is grounded in peer-reviewed science and continuously refined for precision. With ClimateScore Global, banks can turn climate risk into a competitive advantage, driving sustainable growth with trusted, actionable intelligence.

Portfolio & Asset-Level Physical Risk Analysis

With its best-in-science, decision-ready analytics, ClimateScore Global quantifies the physical risks to your business caused by climate change. It empowers you to mitigate impacts on your operational and financial performance, comply with climate regulations, and build resilience – worldwide.

see your total risk from all perils. anywhere. anytime

ClimateScore Global is the most complete physical climate risk solution available. With access to over 22,000 data values about your exposure and risk, you can run multiple scenario analyses of any peril worldwide, in 5-year increments from now to the year 2100. Access to the best metric for your specific need (not the “next best”) eliminates unnecessary uncertainty in your projections and reporting.

Understand Climate Risk With Scores

Immediately appreciate what climate risk to your portfolio means for your business. ClimateScore Global’s hazard scores consider both your current risk as well as the change in your risk over time – and whether that change is significant – relevant to benchmarks for your location.

Reveal Your Immediate and Long-Term Financial Exposure To Events

The chain of events that follow both chronic and acute weather events can have devastating consequences to your business reputation and future financial stability. ClimateScore Global provides a comprehensive assessment of the direct financial impact of physical climate change on your operational, market, and credit risk.

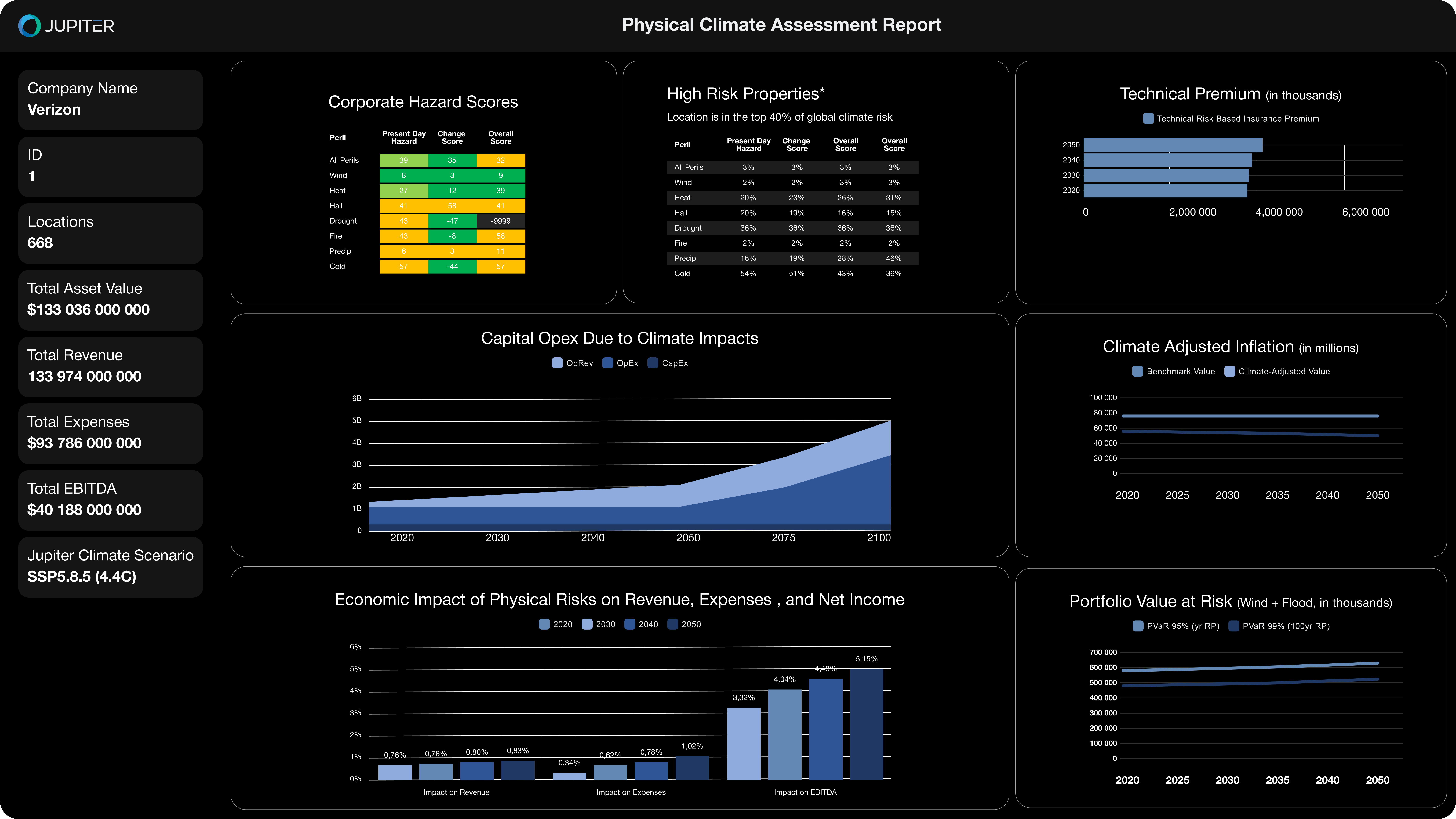

Jupiter Entity Modeling

Jupiter’s Entity Modeling delivers actionable insight on how climate risk translates to financial exposure across companies and capital structures. Built for investors, insurers, and risk teams, it integrates leading climate science with corporate, operational, and securities-level data to evaluate exposure across thousands of holdings. The result is smarter screening, clearer prioritization, and stronger resilience strategy without waiting on perfect disclosure.

Jupiter’s entity-level risk modeling is already supporting stress testing, counterparty risk analysis, and portfolio management at leading banks, insurers, and investment firms, bringing clarity where others see noise.

Jupiter Adaptation Hub

Backed by the most trusted climate science on the market.

Jupiter’s adaptation capabilities represent a shift in how institutions approach resilience. For the first time, customers can quantify adaptation ROI with the same confidence they already apply to risk. That means credible, customized insights on avoided losses, implementation costs, and site-level ROI – delivered within the trusted ClimateScore Global platform available within the Adaptation Hub. From deal teams to ESG leads, this is adaptation planning at the pace and precision of real investment strategy.

Now you can model avoided losses and adaptation costs in one tool. Jupiter’s newest capability makes it easy to justify resilience investments with board-ready analytics.

- A library of 10+ physical adaptation strategies (e.g., flood protection, wind retrofits, wildfire-safe retrofits, cooling systems)

- ROI modeling based on avoided loss vs. adaptation costs, with regional cost adjustments

- Interactive visualizations at asset, sub-portfolio, or portfolio level

- Outputs that include unadapted vs. adapted loss, avoided loss, and ROI over 1-, 5-, 10-, and 30-year horizon

.png)

Jupiter MetricEngine

scientifically grounded climate metrics tailored to your business.

Jupiter MetricEngine delivers dynamic, configurable science-based metrics that plug into internal models for capital planning, stress testing, and pricing. If you’re tasked with estimating right-tail loss, MetricEngine lets you define the thresholds that matter and model them across time, scenario, and geography. It’s climate science, translated for financial decision-makers.

- Built on Jupiter’s deep reservoir of daily climate projections, extending the value of ClimateScore Global

- Allows users to define intermediate thresholds like “number of days above 35°C”, and compute exceedances over time

- Supports generation of future time series using stochastic weather simulation and distribution sampling

- Enables dynamic construction of return periods and loss curves from modeled extremes

- All metrics are scenario-specific, science-backed, and calibrated to match observed climate behavior

Economic Impact

Secure your financial future against climate change with ClimateScore Global’s economic impact metrics. Understand the direct financial impact of physical climate risk to your operational, market and credit risk. Easily integrate those impacts into your financial projections and reveal how climate change will both intensify your existing portfolio risks and create new ones.

Never let climate induced weather events catch you off guard. ClimateScore Global offers unparalleled metrics so you can keep your operations running smoothly, no matter the climate condition.

Market valuations often miss the "climate variable." We bridge that gap. Our financial impact metric suite intelligently adjusts your asset values to factor in climate risks. Make well-informed decisions, backed by data science.

ClimateScore Global predicts how physical climate risk impacts key credit risk parameters. Predict the probability of credit default related to climate risk before it becomes a financial catastrophe.

ClimateScore Global Flood

ClimateScore Global Flood, Jupiter’s advanced flood model, produces worldwide historical, current, and future flood hazards. Leveraging cutting-edge advancements from the global scientific community and Jupiter’s own team of world-class scientists, CSG Flood™ delivers your risk at flexible resolutions anywhere on the Earth’s land surface.

Combine fluvial, pluvial, and coastal modeling, both defended and undefended, to view your total flood risk.

Modeling

%201.svg)

%201.svg)

Available in 3 resolution ranges, CSG Flood has the flexibility to assess your flood risk from the portfolio to the asset level.

CSG Flood™

- Resolution: 90 meters

- Best used for regulatory disclosures, portfolio level risk assessment.

- Comes standard with all ClimateScore Global packages.

- Globally available.

CSG Flood™ Plus

- Resolution: 10 - 20 meters

- Best used for underwriting, industrial, exposure.

- Available as an upgrade or as a standalone product.

- Available in the US, EU, UK now. Canada Japan, and Australia soon.

CSG Flood™ Focus

- Resolution: 1 - 3 meters

- Best used for single facility risk engineering, individual asset risk assessment.

- Available as an update or as a standalone product.

- Globally available.

ClimateScore Global Wildfire

Understand your hazard and loss risk with the world’s first global wildfire model

ClimateScore™ Global Wildfire produces breakthrough historical, current, and future wildfire risk analysis at 90-meter resolutions anywhere on Earth’s inhabited land surface—leveraging cutting-edge advancements from the global scientific community and Jupiter’s own team of world-class climate experts.

.jpg)

Revolutionizing Wildfire Risk Assessment

Derived from the US Forest Service’s WRC data, Jupiter simulates fire events using extensive geospatial data.

By leveraging climate data, Jupiter adapts the annual burn probabilities to future climate conditions.

Jupiter’s model leverages real-world data from recent wildfires to assess financial losses, adapting to various asset attributes.

Jupiter’s model is equipped to handle various emissions scenarios all over the planet, aligning with other Jupiter metrics.

*Except for Antarctica

At 90-meter resolution, Jupiter’s model delivers more precise risk projections so companies can plan better.

Jupiter’s projections take into account the various types of surrounding environmental factors, which make a significant difference in prediction.

Quantify your potential losses from wildfire worldwide, at high resolution using groundbreaking metrics

Availability

Put Jupiter’s Gold Standard Science to Your Advantage

Scientific

Rigor

Quality Out.

Unmatched

Granularity

Perception

Advanced

Innovation

Insights

Full

Transparency

Mind

Paired with a Jupiter expert that specializes in your industry, we will work together to assess your needs and determine the best-in-science physical climate risk analytics approach for your organization.

talk to an expert.webp)